With 2025 now safely behind us, you might be thinking about how to save money in 2026. Saving money is all about consistency. There’s no flashy, fancy way to make it easier. Planning and persistence is the way to go.

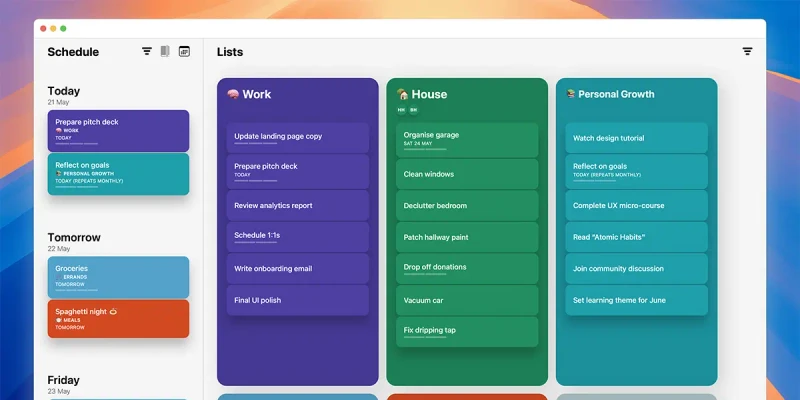

Timepage and Actions aren’t just calendar and to-do list apps - you money-saving enthusiasts can also use them to get your savings in tip-top shape!

Here’s how…

Set up a reoccurring event in Timepage to check your loans every three months

Bankrate suggests refinancing your mortgage, and we couldn’t agree more. Banks are competitive, and interest rates change; this means you should regularly check your mortgage and refinance it if it makes sense. Same with car and personal loans. It is much easier to leave your loan where it is but trust us; the paperwork is worth it to save potentially thousands of dollars on your loans.

Do the same thing with phone and internet plans.

Internet and mobile phone providers can be sneaky, and they’ll leave you on an outdated and expensive plan even if they have a better offer for you. Check out what your current provider is offering and also check out their competitors. If you call your current provider and tell them you’ve found a better deal elsewhere, they might match it. You’ll have to prove to your provider that the other deal exists, but they’ll match it more often than not.

Track your spending

Set a reoccurring event in Timepage for every day and name it Spend Tracking. Open the notes on the event and jot down everything you spent that day. From your morning coffee to the snack bar you bought at the service station - do this for two weeks to get an overview of your daily spending and where you could cut back. It’s a great way to track habitual spending - like avoidable mid-week takeaway and snacks you could have brought from home.

Keep a detailed list of things you need

Never buy anything unless it’s on that list. Start an Actions card of items you need to purchase and only buy from the list. Curb any impulse spending you might be indulging in by checking in with the list regularly. For example, if you notice that you need new measuring spoons when cooking dinner one night, you add it to the list. The next time you see a set of measuring spoons at the shops you can buy them because you need them. If you see a kitchen gadget that you think you might need and it’s not on the list, don’t buy it. If you needed it, you would have put it on the list.

Set a money goal and schedule Actions to help you reach it

Give yourself a deadline. If you want to save $500 over the next few months, schedule the task in Actions. Set reoccurring events to help you. Events like ‘transfer $50 to savings account’. If you’re collecting all your coins and $5 notes, schedule an event to take your money collection to the bank and put it in your savings account. Little reminders will keep you on track and hold you accountable. Turning your goals into habits with Actions is the key to making your savings goals stick.